Many of us who own a regular (or pond) business have dreamed of selling it one day and living the dream of retirement. Most of us have very little idea how to make this dream come true. Usually this only happens with a well thought-out plan. Yes, you need a real plan that will work in the real world. Read on to learn how this process works — and yes, it does work.

Is your company sellable?

I was speaking with a 25-year-old business owner recently, and I asked him what his ultimate goal in business was. He replied, “I want to sell my company one day.” I asked, “For how much would you sell it to me right now?” He replied, “$200,000 to $300,000.”

So, I continued. “Let’s say I give you $300,000 for your company, and you plan to introduce your company to me, the new owner, tomorrow morning. On the way to this introduction, you get hit by a bus. So now, I’m all by myself in front of my new company. Am I going to have a joyous day, or is it going to be the most hellish day of my life?”

“You are going to have the worst day of your life!” he answered.

My reply was simple. “You don’t have a company to sell, then. You have a job — and a lousy one at that. You told me a few minutes ago that you could not even commit to a lunch, because you are flying around like Superman all day, saving your employees and your company from drowning.” Does this sound familiar to you?

Look at your company like an investment.

Suppose I have $300,000 to invest. I could invest it in many ways, but let’s just focus on two options: either I buy your company, or I buy stock in Apple Inc.

If I buy your company, my life will likely turn into a living hell if you are not there with me to help put out all the fires. If I want to quit and get out, how will I ever get my money back? I probably never will, unless I find a bigger fool than I to purchase the company. My investment in your company will most likely be my biggest nightmare.

[box style=”rounded” border=”full”]>> Pond Trends | Perks of Customer Relationship Management Software [/box]

If I buy Apple stock, I don’t have any work or time constraints whatsoever. I can get out of this investment any time and get my money back with a few clicks of a mouse. This investment may be up or down (and lately it’s been way up), but it requires little effort on my part, and my investment is extremely liquid.

The bottom line is, when you go to sell your company, you must ask yourself, “Would I want to buy this company without me here to run it?”

Properly Valuing Your Company

Of course, there are many ways to evaluate your company, but let’s focus on two of them.

First, calculate three times your average net earnings over the previous three years of business. For example, let’s say you have an average net profit of $100,000 over each of the last three years. So, your business is worth about $300,000.

Second, calculate your annual gross sales. If your company has gross sales of $500,000, then that’s your sales price.

A couple of notes on this: there is a direct relationship between net profit and gross annual sales when calculating your company value. The higher your net profit, the more your company is worth. For instance, if you have $1 million in gross annual sales but only $100,000 in net profit, your company is worth closer to $300,000 than $1 million. Also, both methods are only a starting point for discussing the value of your company. For instance, the more your company can operate without you, the more it will be worth to a future buyer.

A couple of notes on this: there is a direct relationship between net profit and gross annual sales when calculating your company value. The higher your net profit, the more your company is worth. For instance, if you have $1 million in gross annual sales but only $100,000 in net profit, your company is worth closer to $300,000 than $1 million. Also, both methods are only a starting point for discussing the value of your company. For instance, the more your company can operate without you, the more it will be worth to a future buyer.

So, the more your company is set up like a franchise (like McDonald’s) and can operate with anyone at the helm, the more appealing your company will be to sell.

How do I find a buyer?

I have bought and sold several companies, and it’s not an easy process. It takes time and planning to do it right. In fact, this is so daunting of a process that most small-business owners just shut down their companies and walk away.

According to Alpine Business Brokers, “Reliable sources report that approximately 20 percent of small businesses are for sale at any one time. Only about 20 to 25 percent of these will actually sell.”

In translation, the clear majority of all businesses do not sell.

However, there are three viable strategies for most business owners to consider when they’re in a position to sell.

1. Hire a business broker to sell your company for you.

This is a relatively easy option, but sellers beware. Business brokers are in it for the commission of the sale. I have hired a few in my past, and I have found that they usually have their own best interest at heart — not yours. I once owned a high-end hair salon that a broker sold for $15,000 — the amount of inventory on the shelves. My partner and I had invested $250,000. All of it was lost because the business needed a capable full-time owner, and the broker simply took the first deal that was offered. My partner and I were so frustrated with the business that we were OK with walking away and taking our losses.

2. Find an existing business to buy you out.

This strategy requires homework, luck and timing. You will need to find a similar or complementary business that can monetize your company. Usually they will require you, the owner, to stay on for a year or two to help with the transition. They will often protect their investment by tying the future performance of your company into the purchase price. Basically, they want to make certain that the company they are buying is exactly what you have represented to them. In other words, if you sell someone a car with a hidden mechanical problem, they will find out, and you’ll have to make it right. You need to be open and honest, or someone will get hurt in this scenario.

3. Produce your own buyer from inside your company.

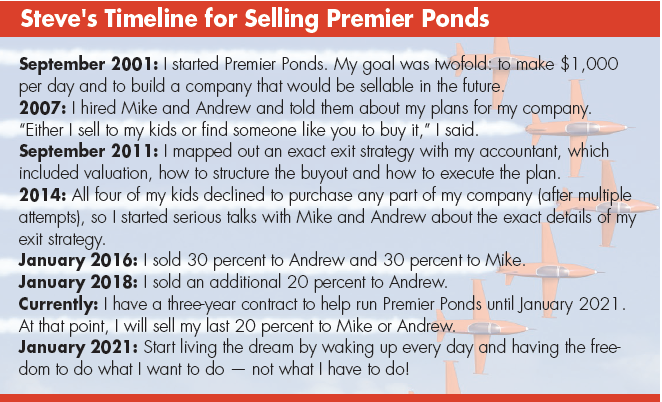

This is the strategy I am currently using to sell Premier Ponds. It has been 10 years in the making. You must make certain that the next generation of owners has the right stuff to run the company and buy you out. There are a couple of ways to sell your company to current employees.

First, they can hand you the money, and you’re done. This is extremely rare. After all, if they had access to that kind of money, chances are they could simply start their own business. They will need to know that they are better off buying your business than starting their own. Numbers don’t lie; people do.

Second, you can present them with an “earn-out.” Basically, you lend them the money plus interest to buy you out. The trick here is to properly value the sale of your company so they can pay you back as agreed. Again, you must work out the numbers with them. All of you must know that given a reasonable assumption of future earnings, they can both pay you back and feed their families at the same time. The last thing you want is for the deal to go bad. You must calculate a fair price that is achievable for everyone involved.

You must be willing to sell or buy your company at the same price. It is crucial that you create a win-win scenario. You will need an accurate accounting of your past business to show the new owner that the deal is doable. You do not want to sell your company on a wing and a prayer.

How many years should it take to pay the owner back?

In other words, how many years would you want to work to pay back the owner of a business you purchased? Usually the answer is between three and seven years. I think that when you try to set a price to sell your company, you need to put yourself in the buyer’s shoes. Would you take the same deal that you are offering?

It takes time and an accurate set of numbers to properly structure a buyout. I recently read a memo from my accountant dated September 2011 outlining the exact buyout deal that I’m currently executing. A written, executable and realistic plan is paramount. Start that today.

A lawyer will be necessary to draw up the proper paperwork, legally execute a binding contract and spell out any repercussions if things go south following the sale.

Here are a few what-if questions that you will need to know the answers to in advance:

• What if the new owner becomes incapacitated or passes away?

• What if the new owner needs to leave the business for honorable or inevitable reasons?

• What if the new owner leaves the business for less-than-honorable reasons?

• What if they don’t or can’t pay you back as scheduled?

• What if you want back into the business?

• How do you resolve conflicts?

A good lawyer will have the answers to these questions and more. It’s an absolute must to do it the right way. This is no time to go cheap. You are talking about the lives of others, as well as your own retirement.